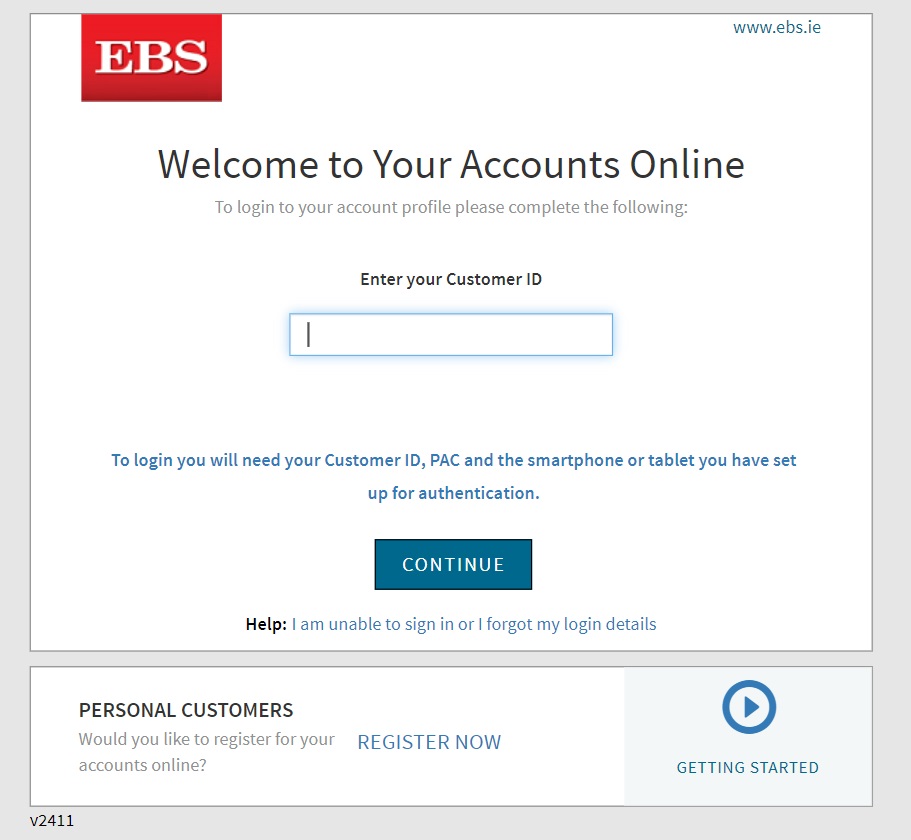

EBS Online Banking Login

You can visit the EBS Online Banking login page to review all transactions made by EBS Online and get information about them. In order to easily check all the transactions made by EBS Online and get information about them, you need to go to the EBS Online Banking Login page. This home page will help you with the introduction.

Does EBS Do Online Banking?

EBS (Educational Building Society) is one of the largest banking and financial service providers in Ireland province. However, whether EBS offers “internet banking” services should be examined and extreme situations should be taken into account. Based on this information, it would be wise to make an application that may be useful to you.

Obtaining the most up-to-date and accurate information by visiting the official EBS website or contacting customer service gives you easier access and understanding. Usually, large financial institutions offer internet banking services, so it is expected that EBS will also offer such services. In general, large financial institutions offer internet banking services, so it is likely that EBS online banking such services as well.

What Is EBS Banking System?

EBS Banking System refers to the wide range of banking services that EBS ie online banking offers to its customers. The EBS Banking System refers to the wide range of banking services that EBS, i.e. internet banking, offers to its customers. This system offers a variety of financial products and services to meet customer needs:

- Housing Loans: If the EBS system and the people who use it want to become a homeowner, they can access a housing loan with ygun interest rates and flexible paying options.

- These accounts you have opened offer you various opportunities with high interest rates and flexible withdrawal options.. If you wish, you can use this type of account or just use it to do research.

- Investment Products: It offers various investment products to you valuable users so that they can make their savings more profitable and shows you the way to make the most of it. You can evaluate these products by buying mutual funds, bonds and stocks.

- Insurance Services: EBS offers different insurance products to guarantee the lives of its customers. Options such as housing insurance, life insurance and car insurance are available.

How Do I Use EBS Online Banking?

EBS internet banking offers customers the opportunity to perform banking transactions easily and securely. You can follow the steps below to use EBS online banking Ireland:

- Record: Sometimes if you are going to use EBS internet banking for the first time, you need to register first. The registration process is extremely reflection, and you will be able to log in by following the trails.

- Log in to your account: After the registration process is completed, you can log in to www EBS online banking. With this step, you can access it either from the Internet or from the application.

- Complete the Security Steps: After logging in, a few additional steps may be required for your security.Oct. Usually these steps are verification steps that protect your password and your rights.

- Use the account features and security measures

When you visit the website, you can easily access all the details. The menu tabs here have a style that everyone can easily understand. Thanks to the easy understanding of its features, it exhibits a user-friendly attitude. If you wish, you can contact EBS through any channel and choose EBS for your own business. If you already have an EBS account, logging in from my EBS login tab is as easy as a click. This login screen appeals to everyone’s perception by having an easy interface.

What Do EBS Do?

The basic activities and services offered by EBS online banking ie the main activities and services offered by EBS online banking are to provide loans, direct your investments and perform all your banking transactions at once thanks to the online access feature. In this way, whether you are on the road or at work, all operations can be performed. In order to benefit from the practicalities brought by the age of technology, you will have the advantage of being able to perform your transactions in a short time thanks to this kind of application.

What is EBS Used for?

EBS offers a variety of services to facilitate daily banking transactions, including current accounts, credit cards, ATM services and online banking. With this application designed for you, you can get financial solutions in a short time, and you can perform all your transactions even on the road without stress.

The EBS online banking form provides financial planning and investment consulting services to its clients. These services include personalized solutions to help clients achieve their financial goals. Transactions such as checking account balance, money transfers, bill payments and investment management can be done via internet and mobile banking.

What Is EBS Function?

However, whether EBS login online banking has a specific function or structure may vary depending on which country or region it belongs to. The EBS function, as described in the paragraphs above, provides the principle that purely financial issues can be easily solved with a few clicks.

You can pay an invoice while you are walking on the road or between your transactions, so this banking application shows you the way. Investing money in a functional sense is to follow up investments and manage all kinds of other financing activities.

When Would You Use EBS?

The best times to use EBS or a similar educational fund or program are:

- For Educational Expenses: When it is necessary to cover the cost of education or training. This could be to pay for school, university, technical training or other educational programs.

- When Financial Support is Needed: When it is difficult to cover educational expenses due to personal or family financial difficulties. EBS online banking support can help in these situations.

Usually, in order for this application to be used, it is necessary to download the application and have an idea of what the financing origin you have will do. If you want to evaluate your money by making a good investment, you will have the advantage of being able to use EBS at this very time. It is the most ideal banking application for financing planning thanks to the management of easy investment instruments and simple monitoring of markets.

Pays paydays apart from this, if you have an education or a different payment request, you can easily make payments on the upcoming paydays by tracking your invoices from here. In general, this method is most often preferred.

Why Is EBS Needed?

As they make increasing technological advances, people’s time is much more limited. For this reason, you may forget to pay your bills, or you may not be able to track your investments well. Thanks to EBS, it will be possible to solve this problem radically and make it easier for you. Of course, it is necessary because a good practice for managing a regular income or using it wisely also carries a guiding feature.

How Does an EBS System Work?

EBS is a system used in the banking sector. EBS enables banks and customers to perform banking transactions securely electronically.

- Login and Authentication: User Login: The customer logs in to the bank’s electronic banking platform (internet banking, mobile application, etc.) with a username and password.

- Transaction Selection: Services: The customer can select various banking transactions such as viewing account information, transferring money, paying bills, and making credit card payments.

- Transaction Approval: Data Control: The user reviews the transaction details and ensures that they are correct.

- Transaction Execution: Data Communication: The system securely transmits the necessary information to the bank’s central server.

- Result and Notification: Transaction Completion: The transaction is successfully performed.

EBS systems are constantly updated and improved in terms of security and user experience.

How to Send a Bank Transfer on EBS Online?

To send a bank transfer in EBS Online banking application form, you usually follow these steps:

- Log in: Log in with your username and password. Additional security steps (for example, SMS code or two-factor authentication) may be required.

- Select Transfer Transaction: Find “Money Transfer”, “Wire Transfer” or “Send Money” in the main menu or transactions section. And then Select “Bank Transfer” or similar. (In some systems, this option may be called “Wire Transfer/EFT”).

- Enter Recipient Information: Enter the recipient’s bank name, account number or IBAN (International Bank Account Number). Enter the recipient’s first and last name (this information may be required in some systems).

- Specify the Amount to Send: You should enter the amount that you want to send. You can add a note explaining the transaction.

- Confirm Transaction: Carefully check the information entered. Make sure everything is correct. Confirm the transaction. In some cases, the bank may request an additional security step (for example, OTP – one-time password) for transaction confirmation.

- Transaction Summary and Record: Once the transaction is completed, you can usually review your transaction and access your records from the “Transaction History” or “Transfer/Transfers” section.

What Is 6 Digit Code for EBS Online Banking?

The 6-digit code used for EBS online banking app is generally known as a one-time password or verification code. You may need to enter this code when confirming your transaction or logging in.

Is EBS Online Banking Down?

There are various reasons for failures or interruptions in EBS online banking down systems. If you are experiencing a problem with EBS online banking not working, please follow the steps;

- Social Media and Forums: Check the bank’s social media accounts or banking forums. Other users may be experiencing similar problems, and the bank may have made a statement about the problem.

- Contact Customer Service: Customer service can usually provide information about failures and system outages.

Does EBS Have An IBAN?

Since EBS refers to a banking system, EBS building society online banking not. EBS, that is, electronically and app-based, this application refers to a banking system, so of course the IBAN number belonging to EBS building society internet banking itself is not found. The IBAN number is usually used to identify the bank accounts of individuals and organizations and is a unique number for each bank account.

How Much Cash Can I Withdraw From EBS?

Cash withdrawal limits via EBS (Electronic Banking System) generally depend on the policies and account type set by the bank. These limits can be set on a daily or monthly basis and may vary depending on various factors.

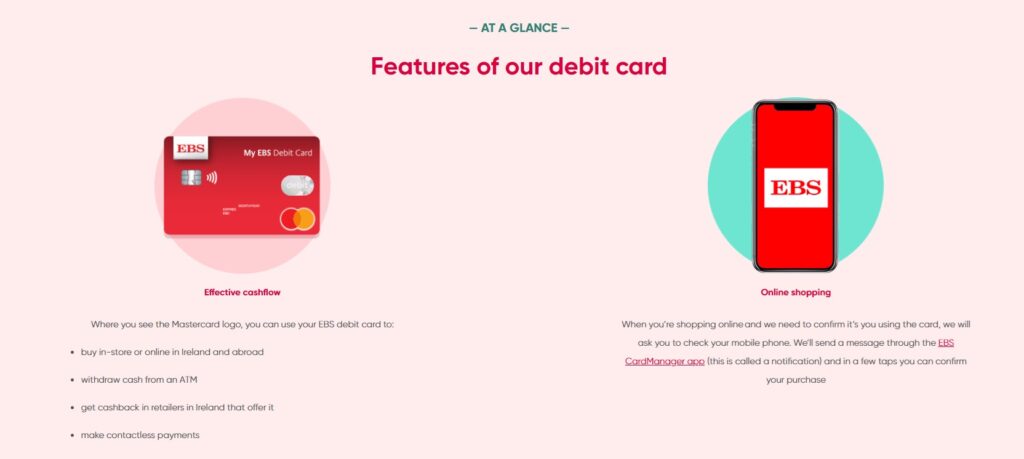

Is EBS Debit Card A Visa or Mastercard?

To determine whether an EBS (Electronic Banking System) bank card is Visa or MasterCard, you can look at the logo on the physical card. Both payment networks carry their own logos and brands:

- Visa Cards: Visa’s logo is usually in the shape of a “V” and may be designed with blue and gold on the front of the card.

- MasterCard Cards: MasterCard’s logo is designed with two circles (red and orange) and is located on the front of the first card.

You can get information through EBS online banking contact number.

How Do I Transfer Money from EBS To Bank Account?

First, you can follow the steps by logging in to your bank’s internet banking platform or mobile application. After logging in, find the money transfer tab and log in the information such as the required recipient, amount, IBAN or account number. After the transaction is completed, you will be shown a confirmation message, and the transaction details will usually be notified by e-mail or SMS. You can easily contact EBS online banking phone number also.

What Is the Limit of EBS Online Transfer?

EBS (Electronic Banking System) usually regulates an online transfer limit specific to customers. This is updated according to the frequency of use and credit rating of each customer. Especially if you are trading frequently or this limit may be quite high.